What is Form 941?

Also recognized as a quarterly tax return, Federal Form 941 happens to be an IRS return that is used by the employers for reporting their FICA taxes that are paid as well as owed for the time being.

Also, must report the Withholding amounts due from Medicare wages for both the employees and the employer, Withholding taxable social security wages, Adjustments for sick pay and tips, Any underpayment or overpayment, and even more.

The IRS makes use of this form for calculating the amount of tax payments from employers during the year plus the amount of taxes that are due towards the finishing of the year. This form must be filed by every employer no later than a month following each quarter’s end.

Visit irs.gov to learn more about 941.

Who must File Form 941?

Commonly, any business or person that pays wages to the employees must file 941 each quarter. Additionally, he must continue to do this even when there isn’t any employee at the time of some of the quarters. Something otherwise only happens to this when there are seasonal employers who do not pay employee wages at one or more than one quarter. Again, the exceptions also happen in the case of employers of agricultural employees and household employees.

When to File Form 941?

As you should file a distinct form for every quarter, the IRS does impose 4 filing deadlines and every person must adhere to it.

| Quarters | Deadlines |

| Jan 1 – Mar 31 | April 31st |

| April 1 – June 30 | July 31st |

| July 1 – September 30 | October 31st |

| October 1 – December 31 | January 31st |

You must always keep this in mind that the filing deadline does fall on every month’s last day following the quarter’s end. It will provide you one full month for preparing the form prior to submitting it.

How Should You Complete Form 941?

Whenever you prepare a Form 941, you should report your employees’ number that you possess besides the wages that you paid plus the amount of taxes that you withheld for arriving at the amount that you should send to the IRS. Prior to beginning the tax return, a person needs his payroll records and documentation for any kind of taxable tip that his employees report to him.

When a person does calculate the amount for sending to the IRS then besides the federal income tax, the payment should reflect 6.2% of every employee’s wages. It will also comprise 1.45% of every taxable wage for Medicare tax.

After Tax Year beginning December 31, 2013, The credit for COBRA premium assistance payments cannot be claimed on Form 941.

You can file 941 with the IRS by Paper or electronically. IRS recommends employers to file 941 electronically to get the instant results.

Where to Mail Form 941

| IF you’re located in | Mail return without payment | Mail return with payment |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0005 | Internal Revenue Service PO Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| No legal residence or principal place of business in any state: | Internal Revenue Service PO Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

| Special filing address for exempt organizations; governmental entities; and Indian tribal governmental entities; regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 | Internal Revenue Service P.O. Box 932100 Louisville, KY 40293-2100 |

Paying Taxes with Form 941

When you have become successful in paying the entire amount comprising payroll tax return during the months that are covered by Form 941, then you must see “$0” due, and it is pretty good. Now, if you really do owe taxes then what should you do? In this situation, you can’t wait until you file the form to pay all the taxes. Then, you should make either semi-weekly or monthly deposits based on the amount that you owe.

What about penalties and interest if you miss the deadline?

When you fail to file the form, then it can result in a 5% penalty of the tax which is due with that return. The penalty does cap out at 25%. A distinct penalty does apply for making late tax payments or paying lesser than a person owes. The IRS does charge you 2-15% of your underpayment based on the days that you are late for paying the appropriate amount.

File 941 before deadline and avoid late Filing penalties!

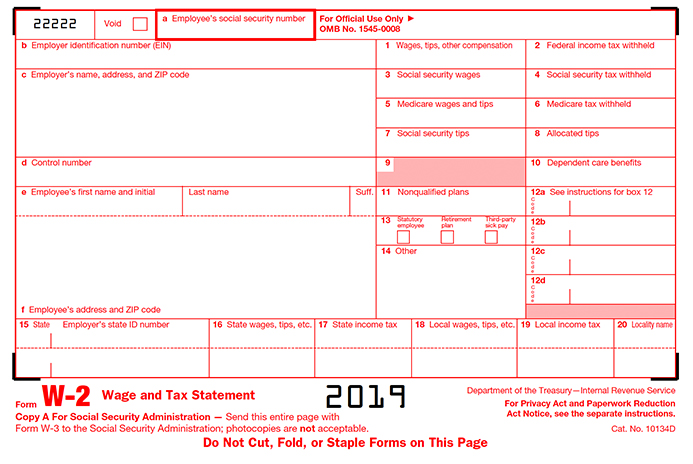

Also read: Form W-2, Wage and Tax Statement – What Employers Should Know