The form 1099, also referred to as “information returns,” deals with income generated from self-employment earnings, interest, and dividends, government payments, and other incomes other than wages, salary. This is a chain of documents initiated by the Internal Revenue Service (IRS), where you disclose various types of income you collect all through the year. This form was created by IRS in 1918 for filling tax of the previous year if salaries paid-in surplus of $800. Information provided on Form 1099 helps you to complete your own tax return. You can use single combined Form 1099 for furnishing all 1099 operations for the entire year.

What is form 1099 and types of 1099

The person or organization that pays you is accountable for filling the suitable 1099 tax form and dispatching it to you within 31st January. So 1099 due date is 31st January. If you are employed, then your employer files your annual income to IRS u/s W-2 form. If you are a self-employed or independent contractor, every business entity with whom you deal must give you a form 1099-MISC for the payment of $600 or more. If you are hired by individuals or companies on a contractual basis, then they should furnish you form 1099-MISC for each and every payment they render to you. While you prepare for a tax return, you must disclose all the incomes and payments you received during the year and pay tax upon them, irrespective of you receive 1099-MISC or not. Income from rent was also incorporated in this form, 2011, under the Small Business Jobs Act of 2010.

Types of Form 1099

Form 1099-Div is used to report dividends and other incomes you receive from your stock and mutual fund investments. It is different from the gain you make from selling stock.

If you receive interest from other investments, you furnish it under form 1099-INT. Generally, you receive from your bank where you have the account, and interest is credited.

Government agencies usually give Form 1099-G for any unemployment compensation or state income tax refund you receive from them. You only include the state refund in income, which you claimed for the previous tax year.

If you withdraw from pension, annuities, or profit-sharing plans, then you receive a form 1099-R, stating the total amount of withdrawal for the entire year. The form states the taxable amount of distribution and amount deducted as federal tax.

When a creditor cancels a portion of your outstanding debt, then your taxable income increases in spite of not receiving any payment from them. Debt cancellation is treated as income by the IRS, and it can be taxable. Form 1099-C is used to report the debt cancellation, and the minimum amount at which it is issued is $600.

There are other types of Form 1099 like 1099-B for broker and barter exchange,1099-H for health insurance coverage,1099-LTC for insurance,1099-S for real estate transactions, and others.

How to file 1099 forms

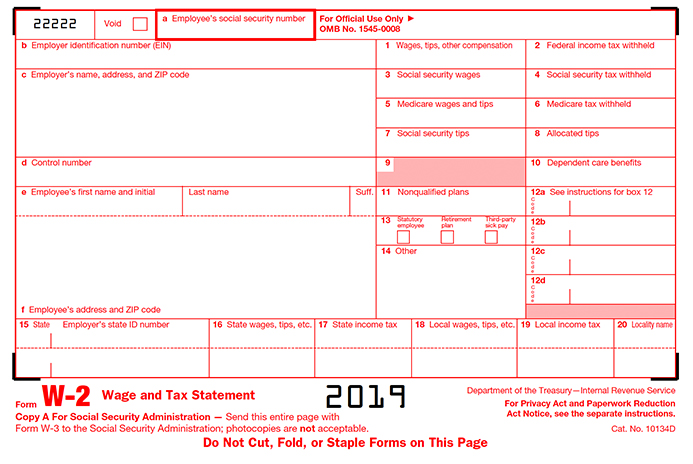

For the paper filling, first, obtain an empty 1099 Form, which is printed in special paper from the IRS office or another source. Each form comes with five copies, write or type on the upper copy so that the content is embossed on other pages. Copy A should be sent to IRS, copy 1 to the suitable state tax agency, Copy B, and 2 to income`s address( one for the return purpose, one for self), copy C for your own record. After completing Form 1099, you should file form 1096 also. Form 1096 is a summary of all the information of form 1099 and to be filed with IRS. The mailing address is on the last page of Form 1096.

All types of form 1099, including Form 1099-MISC, can be filed online or by mail to the IRS through Filing Information Returns Electronically (FIRE) system. For e filling, you need not submit form 1096. You need IRS Form 4419 to submit form 1099 electronically. Submission of IRS Form 4419 should be made 30days prior to the due date to IRS.1099due date is the last day of February. Carefully read the instructions for the requirement for file 1099 digitally on the FIRE system. From 2020 you must file Form 1099 and W-2s online if you file 250 or more one type of form for one year.

What information do report on form 1099

The form 1099 furnishes information regarding payments to independent contractors, rental income, income from dividends and interest, sales proceedings, and other miscellaneous incomes. You can download blank form 1099 from the IRS website and read the instruction for filling it.

When is the deadline to file 1099

For Form 1099- MISC 31st January is the deadline with an amount in box 7, nonemployee compensation. For other forms of 1099, 1096 filing due date is the last day of February. For e filling the deadline is 1st April. Due date of receipt is 31st January.

What are the copies available in form 1099

There are two copies, copy A and copy B in form 1099. If you hire an independent contractor then furnish the payment you make to them in copy A and submit it to IRS by 31st January either physically or digitally. Dispatch copy B to all independent contractors within 31st January. To complete and submit form 1099 you must have information about the total amount you paid to them in a financial year, their legal name, address, taxpayer identification number like Social Security Number.

If you have paid less than$600 to independent contractors within a financial year, you need not file Form 1099- MISC. On the other hand, if you are an independent contractor, you need to report all your income even it is less than$600 and did not receive a Form 1099. An independent contractor can be anyone whom you hire on a contract basis to complete a particular project or assignment. He is not an employee of your company. If you hire a freelancer through the third party, you need not submit Form 1099 for them. If you hire an independent contractor and pay him more than $600 in a financial year, you are responsible for submitting and issuing a Form 1099-MISC.